Locke Lord QuickStudy: Russia-Related Sanctions Update

Executive Order 14071 “Prohibiting New Investment in and Certain Services to the Russian Federation in Response to continued Russian Federation Aggression” - April 6, 2022

Executive Order 14071 (“EO 14071”) blocks any new investments in the Russia Federation by U.S. persons, wherever located. EO 14071 also proposes to prohibit the exportation, reexportation, sale, or supply, directly or indirectly, from the United States, or by a U.S. person, wherever located, of any category of services as may be determined by the U.S. Secretary of the Treasury, in consultation with the U.S. Secretary of State, to any person located in the Russian Federation. The U.S. Department of the Treasury has yet to identify the specific category of services.

Consistent with U.S. sanctions against Russia’s diamond industry and pursuant to Executive Order 14024, the U.S. Department of the Treasury’s Office of Foreign Assets (“OFAC”) has designated Alrosa Mining Company, the world’s largest diamond mining company, which manages 90% of Russia’s diamond mining capacity and accounts for nearly 30% percent of global diamond mining as a Specially Designated National (“SDN”). Secretary of State Antony Blinken accused Alrosa of helping fund Russia’s war and atrocities in Ukraine.

Pursuant to Executive Order 14024, OFAC also designated Joint Stock Company United Shipbuilding Corporation (“USC”), twenty eight of USC’s subsidiaries and eight members of its board of directors as SDNs. USC has been identified as being responsible for the construction of the vast majority of Russia’s warships, including submarines, frigates and minesweepers. USC operates in the defense and related materiel sector of the Russian Federation economy. The U.S. asserts that USC-built ships are been used to bombard of Ukrainian cities.

Executive Order 14024 and related OFAC actions block all the assets of the above SDNs, which are in the U.S. and further prohibits transactions by U.S. persons with these SDNs. The U.S. has coordinated its efforts to block the assets of Alrosa, USC and their related parties with other Western allies.

While the United Kingdom has taken similar steps banning investment in Russia and freezing the assets of eight additional oligarchs and two additional major Russian banks, Sberbank and Credit Bank of Moscow, other allied nations plan to imposed similar measures. The European Union (“EU”) imposed an embargo on Russian coal and is expected to ban new investment in the Russian Federation.

Concurrent with the issuance of the EO 14071, OFAC issued and reissued several new Russia-related general licenses, and designated additional parties to the Specifically Designated Nationals and Blocked Persons List (“SDN List”).

Left unanswered are (i) the questions of secondary sanctions and (ii) the practicality of doing permitted business in Russia given the impediments to the cross-border banking system.

- The U.S. has indicated it could impose secondary sanctions on China and India for their continued importation of Russian oil. This action if consistently applied, however, could put the U.S. at odds with a number of EU members who remain dependent on Russian natural gas and oil.

- The Russian Harmful Foreign Activities Sanctions Regulations (“RuHSR”) are targeted. Therefore, unless an activity is expressly sanctioned, it is permitted. Additionally, OFAC has issued a number of general licenses that supersede certain prohibitions for either a wind down period or permanently. OFAC issued Russia-related:

- General License (“GL”) 8B (replacing GL 8A), which authorizes, for a temporary wind period, certain energy-related transactions involving the following SDNs that would otherwise be prohibited: (1) State Corporation Bank for Development and Foreign Economic Affairs Vnesheconombank; (2) Public Joint Stock Company Bank Financial Corporation Otkritie; (3) Sovcombank Open Joint Stock Company; (4) Public Joint Stock Company Sberbank of Russia; (5) VTB Bank Public Joint Stock Company; (6) Joint Stock Company Alfa-Bank; (7) any entity in which one or more of the above persons own, directly or indirectly, individually or in the aggregate, a 50 percent or greater interest; or (8) the Central Bank of the Russian Federation.

- GL 9C (replacing GL 9B), which authorizes, for a temporary wind down period, all transactions that are ordinarily incident and necessary to the receipt of interest, dividend, or maturity payments in connection with debt or equity of the following SDNs that would otherwise be prohibited: (i) State Corporation Bank for Development and Foreign Economic Affairs Vnesheconombank; (ii) Public Joint Stock Company Bank Financial Corporation Otkritie; (iii) Sovcombank Open Joint Stock Company; (iv) Public Joint Stock Company Sberbank of Russia; (v) VTB Bank Public Joint Stock Company; or (vi) any entity in which one or more of the above entities own, directly or indirectly, individually or in the aggregate, a 50 percent or greater interest (collectively, “Directive entities”).

- GL 10C (replacing GL 10B), which authorizes through May 25, 2022, all transactions that are ordinarily incident and necessary to the wind down of derivative contracts, repurchase agreements, or reverse repurchase agreements entered into prior to February 25, 2022, that include a Directive entities as a counterparty.

- GL 13, which authorizes U.S. persons to pay taxes, fees, or import duties and purchase or receive permits, licenses, registrations, or certifications, to the extent such transactions are prohibited, provided such transactions are ordinarily incident and necessary to such persons’ day-to-day operations in the Russian Federation.

- GL 14, which authorizes transactions involving any Directive entity where the Directive entity’s sole function in the transaction is to act as an operator of a clearing and settlement system.

- GL 21A, which authorizes through June 7, 2022 the wind down of Sberbank CIB USA, Inc., or any entity in which Sberbank CIB USA, Inc. owns, directly or indirectly, a 50% or greater interest, including payment of salaries, severances and expenses, payments to vendors and landlords, and closing of accounts that would otherwise be prohibited.

- GL 22, which authorizes through April 13, 2022, all transactions ordinarily and incident to the wind down of transactions involving Public Joint Stock Company Sberbank of Russia (“Sberbank”) or any entity in which Sberbank owns, directly or indirectly, a 50% or greater interest that would otherwise be prohibited.

- GL 23, authorizes through May 6, 2022, all transactions ordinarily incident and necessary to the wind down of transactions involving Joint Stock Company Alfa-Bank (“Alfa-Bank”) or any entity in which Alfa-Bank owns, directly or indirectly, a 50% or greater interest that would otherwise be prohibited.

- GL 24, authorizes through May 7, 2022, all transactions ordinarily incident and necessary to the wind down of transactions involving Public Joint Stock Company Alrosa (“Alrosa”) or any entity in which Alrosa owns, directly or indirectly, a 50% or greater interest that would otherwise be prohibited.

- GL 25, which, authorizes all transactions ordinarily incident and necessary to the receipt or transmission of telecommiciations involving the Russian Federation, as well as the exportation or reexportation, sale, or supply, directly or indirectly, from the United States or by a U.S. person, wherever located, to the Russian Federation of services, software, hardware, or technology incident to the exchange of communications over the internet, such as instant messaging, video conferencing, chat and email, social networking, sharing of photos, movies, and documents, web browsing, blogging, web hosting, and domain name registration services.

- GL 26, authorizes through July 12, 2022, all transactions ordinarily incident and necessary to the wind down of transactions involving Joint Stock Company SB Sberbank Kazakhstan or Sberbank Europe AG (collectively, “the blocked Sberbank subsidiaries”), or any entity in which the blocked Sberbank subsidiaries ow, directly or indirectly, a 50% or greater interest that would otherwise be prohibited.

While the above general licenses may seem manageable, the actual delivery of funds for transactions that are compliant with the above is less than clear. OFAC issued FAQ 978 to provide examples of permissible and impermissible examples of funds transfer to Russia which involve sanctioned Russian banks as intermediary clearing agents:

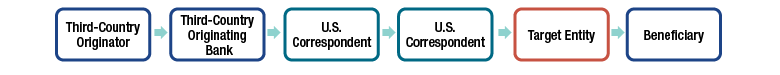

Payment From Third-Country Originator

Authorized payment from third-country originator to beneficiary with an account at a sanctioned institution:

Prohibited payment from third-country originator to beneficiary with an account at a sanctioned institution:

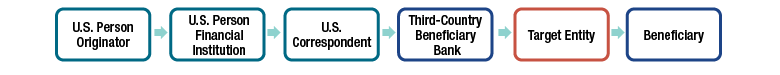

Payment From U.S. Originator

Authorized payment from U.S. originator to beneficiary with an account at a sanctioned institution:

Prohibited payment from U.S. originator to beneficiary with an account at a sanctioned institution:

In each of the above examples, the underlying funds transfer must be authorized under the applicable GL.

Additional SDN Designations

OFAC added additional parties, both individuals and entities, to the SDN List, including two of Russia’s largest financial institutions Sberbank and Alfa Bank, Russian President Vladimir Putin’s adult daughters, Russia’s Prime Minister, and the wife and children of Russian Foreign Minister. As a result of these designations, U.S. persons are generally prohibited from engaging in most transactions, directly or indirectly with parties designated on the SDN List, entities that are owned 50% or more by one or more SDNs, and their property or property interests. Non-U.S. persons can also be exposed to U.S. sanctions liability for “causing” a violation of primary sanctions by U.S. persons or providing “material support to SDNs, which could result in non-U.S. persons being designated as an SDN themselves). Of note, the following Russian insurers have been added as SDNs:

- INSURANCE COMPANY SBERBANK INSURANCE LIMITED LIABILITY COMPANY (a.k.a. LLC INSURANCE COMPANY SBERBANK INSURANCE; f.k.a. OBSHCHESTVO S OGRANICHENNOI OTVETSTVENNOSTYU STRAKHOVAYA KOMPANIYA SBERBANK OBSHCHEE STRAKHOVANIE; a.k.a. OBSHCHESTVO S OGRANICHENNOI OTVETSTVENNOSTYU STRAKHOVAYA KOMPANIYA SBERBANK STRAKHOVANIE; a.k.a. SBERBANK INSURANCE COMPANY LTD; a.k.a. SBERBANK INSURANCE IC LLC; a.k.a. SBERBANK STRAHOVANIE OOO SK; a.k.a. SK SBERBANK STRAHOVANIE LLC; a.k.a. STRAKHOVAYA KOMPANIYA SBERBANK STRAKHOVANIE); and

- INSURANCE COMPANY SBERBANK LIFE INSURANCE LIMITED LIABILITY COMPANY (a.k.a. LIMITED LIABILITY COMPANY INSURANCE COMPANY SBERBANK INSURANCE; a.k.a. SBERBANK LIFE INSURANCE IC LLC)

Based on the White House’s April 6, 2022 statement, additional sanctions is likely to be imposed against the Russian Federation by the United States, along with G7 countries and the European Union, which could include the use of secondary sanctions.

On April 7, 2022, Congress passed two bipartisan bills aimed at levying severe penalties on Russia. This is the first time since Russia’s invasion of Ukraine that Congress has passed its own sanctions measures. The first bill, “Suspending Normal Trade Relations with Russia and Belarus Act”, suspends normal trade relations with the Russian Federation and Belarus, which opens the door for the U.S. to potentially impose higher tariffs on imported goods from the Russian Federation and Belarus. The bill also reauthorizes the Magnitsky Act, which enables the U.S. government to sanction individuals and entities that have committed human rights violations by denying them entry into the U.S., freezing assets held by U.S. financial institutions, and preventing U.S. persons from engaging in transactions with them. The second bill, “Suspending Energy Imports from Russia Act”), ban oil, coal and natural imports from the Russian Federation, codifying an action President Biden already took in March. President Biden is expected to sign both bills.

On February 24, the White House issued Executive Order 14017 (“EO 14017”), which added restrictions designed to prohibit Russia’s import of U.S. technology. The White House stated that it believes these goods are critical Russia’s economy and Putin’s ability to project power. The prohibited articles exports of sensitive technology, primarily targeting the Russian defense, aviation, and maritime sectors to cut off Russia’s access to cutting-edge technology. In addition to restrictions on importation of U.S. goods, the restrictions prohibit Russia’s access to U.S. technologies produced in foreign countries using U.S.-origin software, technology, or equipment. This is similar to U.S. actions taken against China’s Huawei, and includes restrictions on semiconductors, telecommunication, encryption security, lasers, sensors, navigation, avionics and maritime technologies. EO 14017 will also prohibit the sale of “dual use” goods to Russia. Dual use goods are those items that are regulated by the U.S. Department of Commerce’s Bureau of Industry and Security (“BIS”) in categories 3 through 9 of the Commerce Control List. Based on the foregoing, BIS is generally required to deny license applications for shipments those dual use goods to end users located in Russia, except for some narrow cases where the goods can be verified to be used in flight safety and for humanitarian purposes. BIS has added Russia to the EAR’s Military End-User / End-Use (“MEU”) Rule, which also includes Burma, Cambodia, China and Venezuela. The MEU Rule is intended to prevent listed from receiving items contained in a list in Supplement No. 2 to Part 744 of the EAR. The U.S. has been joined by the EU and Japan who will also prohibit export of certain dual use goods to Russian end users.

For additional information involving Russia-related sanctions, visit Locke Lord’s Russia Sanctions Resource Center.

Don't miss a beat.

Sign up for our newsletter and get the latest to your inbox.